What is E-Invoicing, and why is it important?

E-invoicing, or electronic invoicing, involves exchanging invoice documents from a supplier to a buyer, or vice versa, in an integrated electronic format. There is no need for paper invoices, and e-invoicing reduces administrative costs and errors. It also facilitates faster processing and payment cycles, which improves cash flow and operational efficiency. The move towards e-invoicing is part of a broader effort to modernize financial systems and enhance tax compliance.

E-invoicing to become mandatory in Germany

From January 1, 2025, e-invoicing will be mandatory for businesses across various sectors in Germany. This significant change aims to streamline financial transactions, enhance transparency, and reduce fraud. As the deadline approaches, companies must understand the key regulations and their implications.

Importance of the right tool

Adopting the right e-invoicing tools is crucial for compliance and operational efficiency. These tools should integrate seamlessly with existing accounting systems, adhere to regulatory requirements, and offer robust security features to protect sensitive financial data.

ZUGFeRD is a significant step towards standardizing electronic invoicing in Germany, providing a format that is both user-friendly and compliant with legal requirements.

Source: Bundesministerium der Finanzen (Federal Ministry of Finance, Germany)

sysHUB is your tool of choice

Easy to integrate

uniFLOW sysHUB acts as a standardized central hub for all applications involved in the e-invoicing process. Existing customer applications can easily be integrated into sysHUB utilizing a REST-API, or any protocol used by the customer application.

Individual workflow configuration

Thanks to its configurable workflows, sysHUB allows organizations to build, adjust, and manage their e-invoicing workflows to meet their specific needs.

Real-time visibility of invoicing workflows

By automating each step in an invoicing workflow, real-time visibility for the creation and validation process can be provided. Utilizing the sysHUB job perspective means operators can follow up on each step of the process and intervene if required. The workflows give organizations full oversight and control over the entire invoicing process.

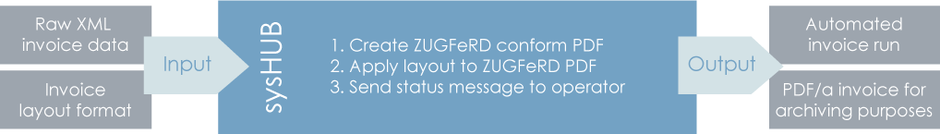

E-Invoicing with sysHUB

uniFLOW sysHUB provides a fully automated e-invoicing solution, from data receipt and validation, transfer to the recipient and, finally, through its preparation and processing. sysHUB ensures that EN16931, XRechnung, ZUGFeRD, and Factur-X standards are met.

Creating e-invoices

Effortless Integration: sysHUB receives XML-invoice data directly from your ERP system, ensuring a smooth and automated invoicing process. No ERP system? No problem! sysHUB can also accept PDF forms from third-party tools and clearly display your invoices.

Seamless Conversion: Once the XML data is received, sysHUB attaches it to a PDF file, creating a compliant ZUGFeRD PDF/A file. This hybrid format combines the best of both worlds, offering a human-readable PDF and machine-readable XML to ensure compliance with the latest e-invoicing standards.

Efficient Processing: Once the ZUGFeRD invoice has been created, sysHUB streamlines invoicing workflow effortlessly, reducing manual intervention, minimizing errors, and accelerating payment cycles.

Validating e-invoices

Seamless Invoice Reception: sysHUB receives PDF invoices with attached XML data, ensuring all necessary information is captured accurately.

Robust Validation Process: sysHUB runs a comprehensive validation process to ensure that your invoices meetusual e-invoicing standards. This step is crucial for maintaining compliance and accuracy.

Instant Feedback:After validation, sysHUB promptly sends a message to both sender and recipient, informing them of the validation results. This transparency helps keep all parties informed and aligned.

Guaranteed Compliance and Efficiency:Successful validation ensures that a valid PDF/A is available for archiving, and the XML data can be used for automated invoice processing. This dual benefit streamlines your workflow and enhances data integrity

Error Handling: If an invoice is found to be invalid, sysHUB stops further processing and returns the invoice to the sender. This proactive approach prevents errors from circulating through your system.

Smooth Archiving and Processing: Once validated, invoices can be securely archived and processed to complete a smooth and efficient invoicing cycle.

E-Invoicing standards incorporated by sysHUB

EN16931: This European standard ensures interoperability across different systems and countries within the EU. It defines the core elements of an e-invoice, facilitating cross-border transactions and ensuring consistency across invoicing practices.

XRechnung: Specifically designed for public sector invoicing in Germany, XRechnung complies with EN16931. It sets the standards for e-invoices used for transactions with federal, state, and local authorities. Any business trading with the public sector must ensure that its invoicing systems meet these standards.

ZUGFeRD: This German e-invoicing format combines PDF with embedded XML data, making it user-friendly and compatible with various accounting systems. ZUGFeRD supports both small and large enterprises to ensure they meet e-invoicing standards while providing a simple-to-use process.

Factur-X: This hybrid e-invoice format used in France, combines a PDF visual representation with an embedded XML file. It ensures compliance with human-readable and machine-readable formats, facilitating easy processing and archiving.